The upsized offering consisted of 30m units at $10, with Centricus offering 5m more units than anticipated. Each unit consists of one share of common stock and one-fourth of a warrant, exercisable at $11.50.

Centricus Acquisition listed on the NASDAQ under the symbol CENHU. Deutsche Bank acted as a lead manager.

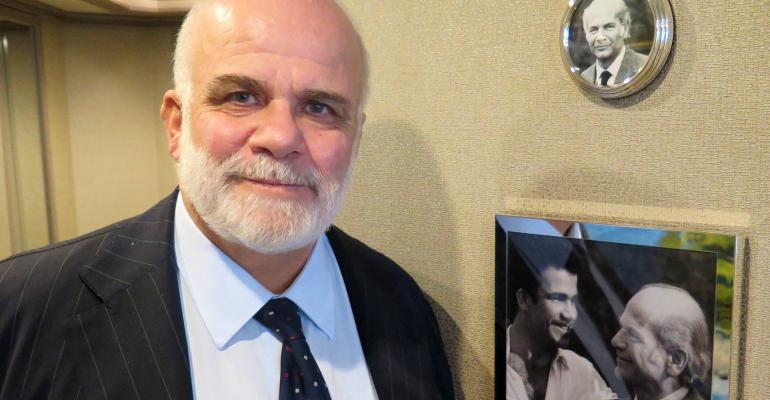

Lefebvre, who chaired Silversea for nearly 20 years and sold his remaining stake to Royal Caribbean Group in 2020, chairs Heritage Group, his investment vehicle. In 2019, he joined Geoffrey Kent in acquiring 100% of the Abercrombie & Kent Group of Companies and the two serve as co-chairmen.

'Missing the cruise business"

Speaking during a cruise session at the Public Investment Fund of Saudi Arabias' recent Future Investment Initiative where the Cruise Saudi initiative was officially launched, Lefebvre said he missed the cruise business.

He did not respond to an email from Seatrade Cruise News about Centricus Acquisition's plans.

In a filing, Centricus said: 'We intend to capitalize on the ability of our management team to identify, acquire and manage a growth-oriented, market leading business.

'While we may pursue opportunities in a vast universe of potential industries, we intend to focus our efforts around leveraging the proprietary networks of our management team and its track record of investment success and expertise in particular sectors.'

CEO Garth Ritchie

The CEO of Centricus is Garth Ritchie, who spent 25 years at Deutsche Bank, most recently as head of the Corporate & Investment Bank division. CFO and Chief Investment Officer is Cristina Levis, chief investment officer of Heritage Group, vice chairman of Abercrombie & Kent, chairman of the digital marketing firm Bucksense and former Silversea chief business development officer and MD of Silversea Expeditions.

Through Lefebvre and Ritchie, Centricus said it offers 'unmatched connectivity across the European landscape, making us the merger partner of choice to European companies with global business models that would benefit from a US listing and access to the US markets.'

The Centricus filing added: 'The coronavirus pandemic has created a landscape where many companies with solid historical performance and strong underlying tail winds could benefit from partnering with us and utilize the additional capital to fund initiatives to further solidify their positions in the marketplace and come out as stronger companies.'

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Cruise News to your Google News feed.  |