17 ships

With the launch of Hanseatic Nature and Marella Explorer 2 in May, TUI’s cruise fleet grew to a total of 17 ships.

'All our brands continue to perform well, driven by robust demand for our attractive itineraries and premium all-inclusive, as well as luxury and expedition product offerings,' TUI Group reported.

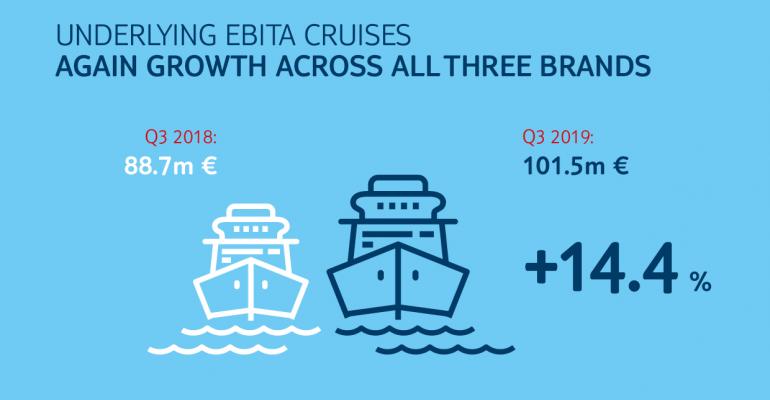

Cruise turnover rose 15.1% to €256.3m, from €222.7m.

TUI Cruises

TUI Cruises' underlying EBITA was up €9m versus prior year. The brand's 30% capacity increase (new Mein Schiff 1 in first half 2018 and new Mein Schiff 2 in Q2 this year) were strong contributors. Average daily rate was down 5%, to €190 from €200, reflecting in part itinerary mix and the significant increase in German ocean cruise capacity this year.

Occupancy averaged 99.5%, up from 98.8%

Marella Cruises

Marella Cruises' underlying EBITA was up €3m, reflecting the addition of Marella Explorer 2 and average daily rate increasing 5%, to £144 from £138. The result was partially offset by the exit of Marella Spirit in Q1.

Occupancy was 98.5%, down from 100.3%.

Hapag-Lloyd Cruises

Hapag-Lloyd Cruises' underlying EBITA increased €1m, driven by average daily rate up 2% (€584 from €571) across the fleet and the new Hanseatic Nature joining in May, partially offset by the exit of Hanseatic at the start of fiscal 2019.

Occupancy was 74.7%, compared to 75.6% a year ago.

Commenting on TUI Group's overall performance, CEO Fritz Jousson said that despite the challenging environment in 2019 to date, underlying business remains robust.

'We expect to deliver a solid performance in 2019, which, however, will not match the prior year’s result, as expected due to the grounding of the 737 MAX. Hotels & Resorts will benefit from our diversified portfolio and cruises will deliver strong growth,' he said.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited. Add Seatrade Cruise News to your Google News feed.